Self-Funding: Some Warnings

Self-funding for long term care—planning to cover costs through savings or investments—is generally not wise for a number of reasons:Asset liquidation.

Even if you have sufficient assets, needing to liquidate those assets to cover long term care costs could represent lost income. A reduced asset pool would likely impact you and your family.

Increased taxation.

Liquidating assets such as IRAs, 401Ks, stocks, and mutual funds all trigger income taxes, which must be added to the overall cost of care.

Lost appreciation.

By self-funding, you would forfeit the potential for future appreciation on the liquidated assets.

Shifting the Risk.

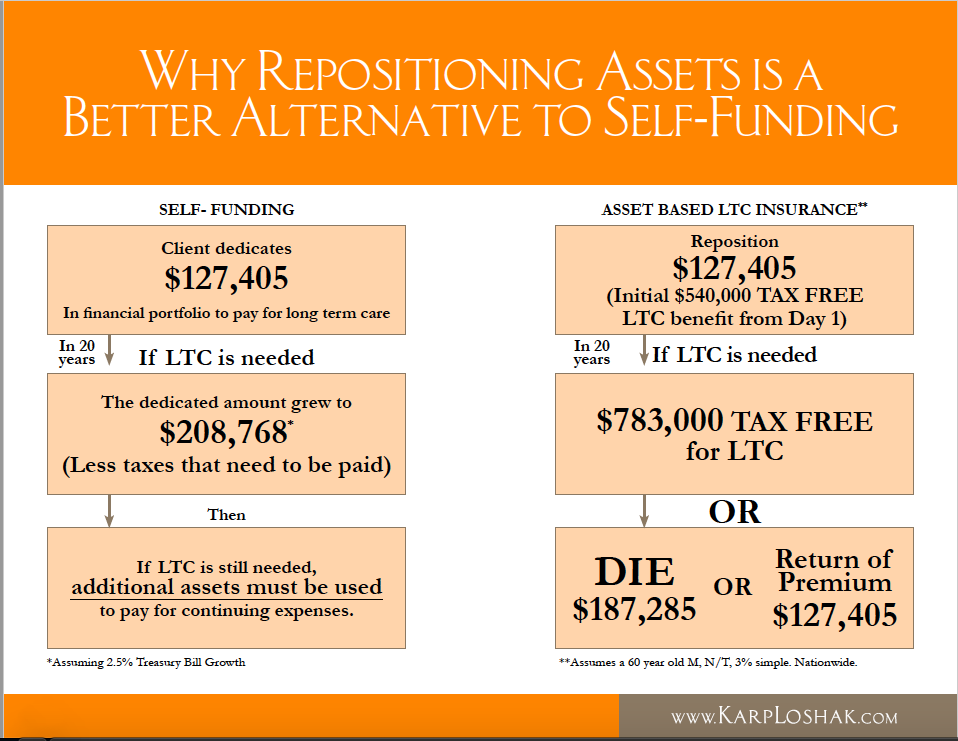

The example below shows why Long Term Care Insurance is a wiser alternative to self-funding—and this holds true for high-net-worth individuals as well.

Self-Funding costs you more — here’s why:

(1)Mutual of Omaha, Standard, Age 60, Married, Female, 3% compound, 40% cash, NYS

Let’s Compare: Transferring the Risk vs. Self-Funding

The cost to transfer the risk does not even include tax credits and deductions. The net effective cost will be even lower.

Which is the wiser choice to protect against the risk?

LTC Stand Alone

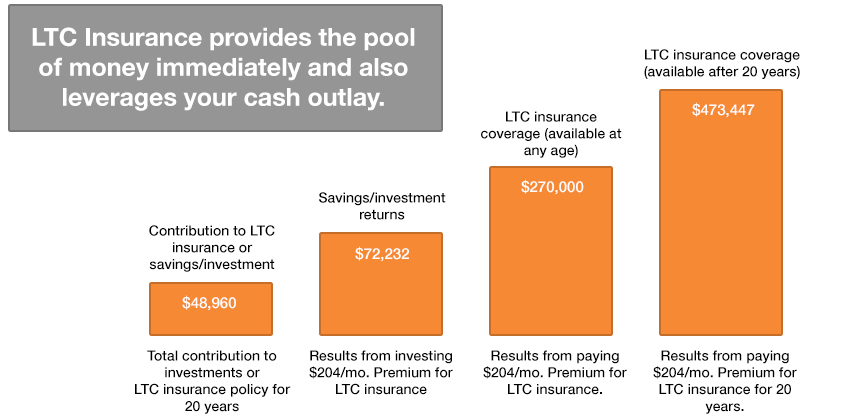

What can you do with $204 per month?

Long Term Care Insurance vs. Investing

*Age 55 preferred, Genworth

$250/day 3 years; 3% compound

As the above example shows, shifting the risk to LTC Insurance gives you an immediate $270K. In 20 years, that money will have grown to $473K. Banking the money with a 3% return produces only $72K in 20 years.

LTC Hybrid